Dupont ratio analysis framework

We are deploying Dupont ratio analysis framework for fundamental stock performance analysis. It provides us insights to the various drivers of return on equity (ROE). ROE is to measure how much return that a company is generated for the shareholders. It is one of the key measures for Warren Buffett to identify his value stocks. Dupont ratio analysis technique further enables us to focus on the individual key financial performance metrics that drive ROE. Therefore we have better understand the strengths and weakness of a company

Return on asset (ROA) measures a company’s operating performance independent of its financing decisions and it tells us how effectively the resources (assets) being used to generate profits.

Financial leverage tells us how much debt that a company is used to increase its total assets

Where,

Profitability is also called Return of Sales (ROS), which is defined as Net Income divided by Sales and it tells us how much profit that a company earns on each dollar of sales.

Financial Leverage is defined as assets divided by equity and it tells us how much debt being used to increase the total assets.

Efficiency is also called Asset Turnover, which is defined as Sales divided by Assets and it tells us how much sales that a company created by using its available assets.

For example:

Among S&P500 stocks, FB is within the sub-sector of Interactive Media & Service under the sector of Communication Services.

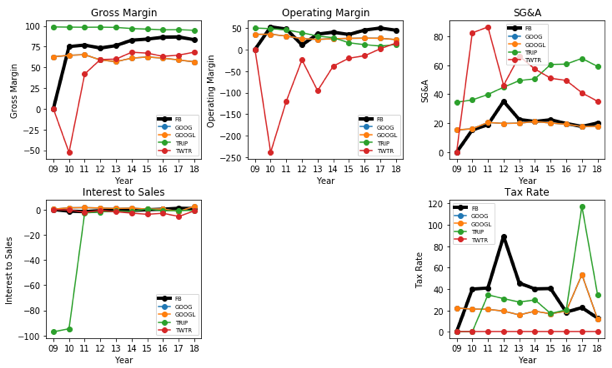

Profit margin

Profit margin ratios tell us the drivers of profitability, which we can decompose by divided by the total sales from the income statement. This includes Gross Margin ratio, SG&A-to-Sales ratio, Operating Margin ratio, Interest Expense-to-sales ratio.

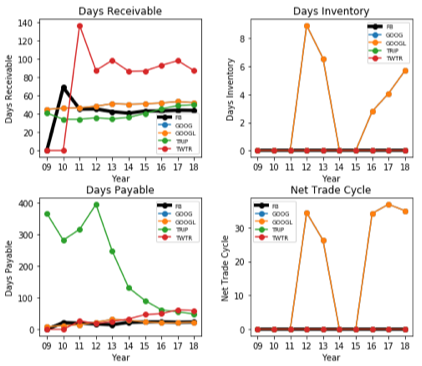

Efficiency Analysis

Net trade cycle tells us the gap between cash outflows and cash inflows that a company have to bridge with short-term borrowing.

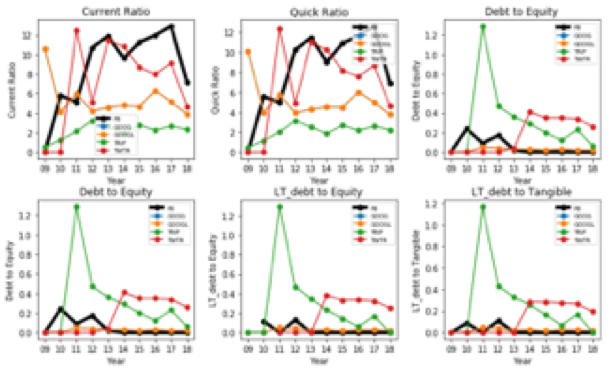

Liquidity Ratios

Liquidity has short and long term liquidity. For short-term, we have current ratio, quick ratio, CFO to current liabilities. For long-term, we heave debt to equity, long-term debt to equity and long-term debt to tangible assets.