Machine Learning in FinTech

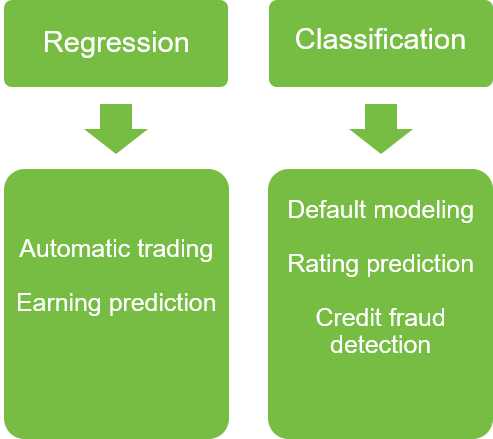

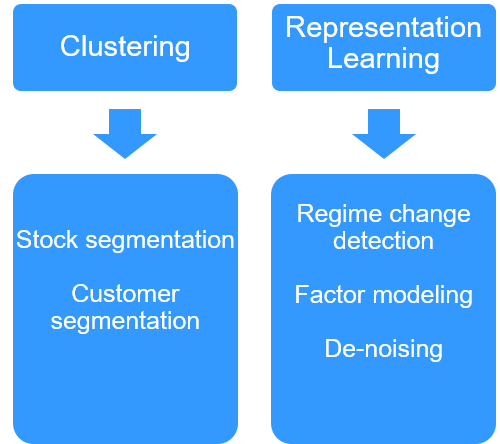

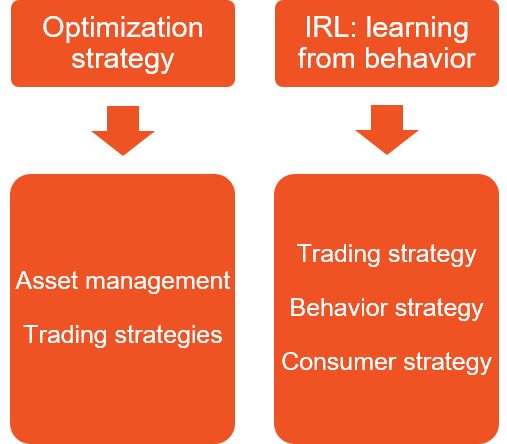

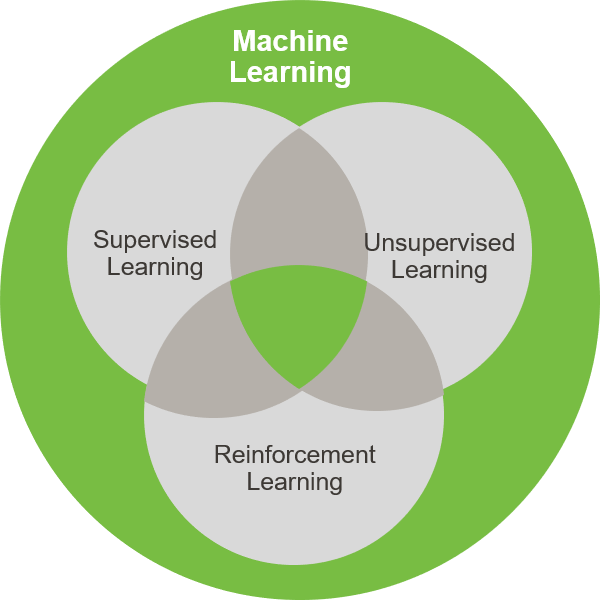

Machine learning includes supervised learning, unsupervised learning and reinforcement learning. Perception tasks involve with supervised learning (SL) and unsupervised learning (UL) whereas action tasks require reinforcement learning (RL).

In Tech, typical perception tasks are image recognition, NLP tasks, which are taken care by SL, UL and typical action tasks are advertising, robotics, self-driving cars etc, which are taken care by RL.

In Finance, perception tasks may also involve RL because these tasks need to predict future actions. There are many deep learning frameworks that are suitable for finance ML modeling such as TensorFlow, Keras, Theano and etc.

Stock analysis for long term investment

Fundamental analysis

Security valuation

- accounting information

Technical analysis

Identify patterns in pricing dat

Predict future performance

Quantitative analysis

Probabilistic models include

- market data

- macro-economic data

Alternative data

Sentiments model uses

- geo-location data

Predict earnings or stock prices

Features for Value Investing

Profitability

ROA (return of assets)

Delta ROA

Cash flow from operation

Return on equity (ROE)

Leverage / Liquidity

Delta Leverage

Delta Liquidity

New Equity issued?

Operating Efficiency

Delta Margin

Delta Turn-over